From DeFi to TradFi

We partnered with Vest during one of the most critical periods in its journey, leading a full product and brand realignment at a pivotal moment.

The results speak for themselves.

Following the repositioning, Vest’s TVL grew from $1.7M to $31M, a ~1,720% increase.

At the same time, total cumulative volume surged from $870M to $5.9B, representing a ~6.8× increase.

This represented a step-change in scale and traction by tapping into a blue-ocean market.

1720%

Increase in TVL

6.8x increase

Cumulative Volume

Category

Service

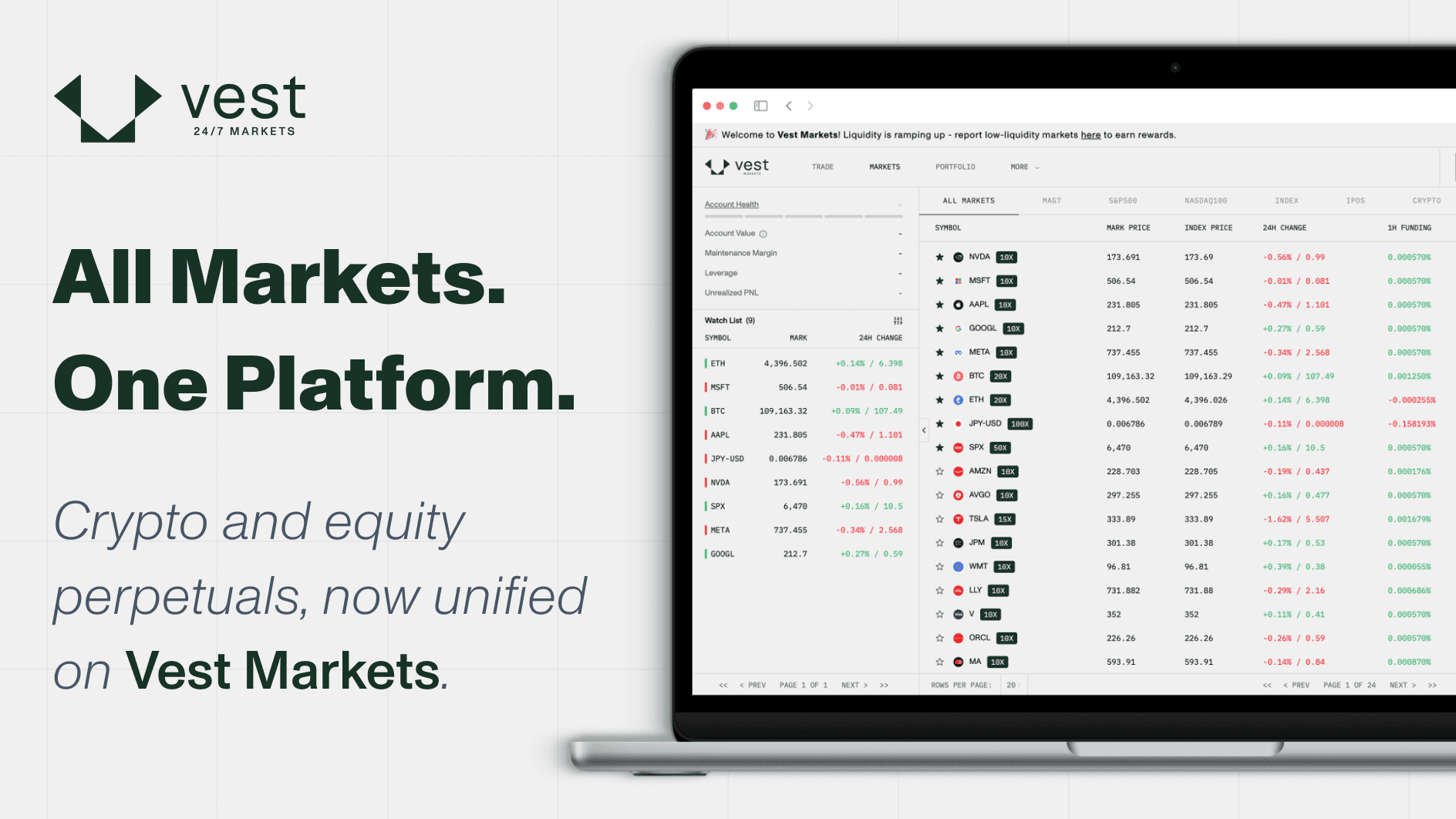

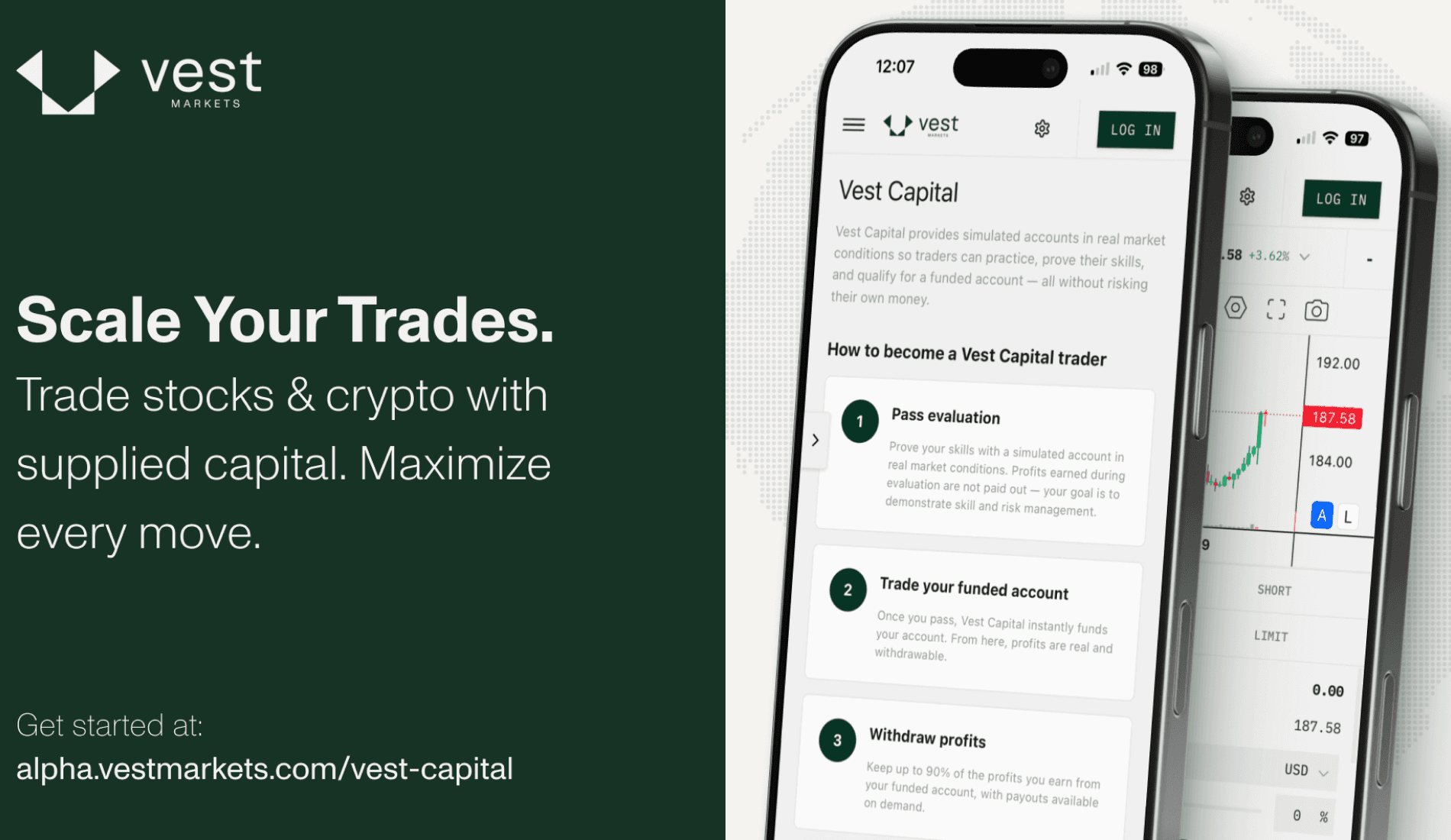

Vest Markets is a platform offering 24/7 zero-fee trading across equities, crypto, and FX, built to simplify the trading experience for end users.

The company originally launched as Vest Exchange, a crypto-only perpetual DEX operating in a highly competitive market. As part of its evolution, Vest underwent a strategic rebrand to expand beyond crypto perps, repositioning itself for a broader, blue-ocean opportunity across multiple asset classes.

Our team supported Vest through this transition by leading the rebranding strategy and managing its end-to-end social presence. This included full social media management, community management, and 24/7 monitoring aligned with platform liquidity, as well as real-time coverage of major market events and new listings.

Challenge

Product and Brand Positioning

Vest Exchange originally adopted a degen, colorful, and high-energy brand, designed to resonate with a crypto-native audience and the norms of a highly competitive perpetual DEX landscape.

With the evolution to Vest Markets, the opportunity expanded beyond crypto. Entering equities and TradFi-adjacent markets required a fundamental shift in tone, messaging, and visual identity to appeal to a more sophisticated and broader trader profile.

As Vest Markets evolved into a 24/7 futures trading platform, offering up to 50× leverage across thousands of NYSE markets—an innovation within the space—the brand needed to signal trust, scale, and institutional-grade ambition without losing accessibility

The visuals below reflect this transition: a cleaner, more refined design system built to resonate with this new audience, while clearly communicating Vest Markets’ expanded product scope and market positioning.

Strategy

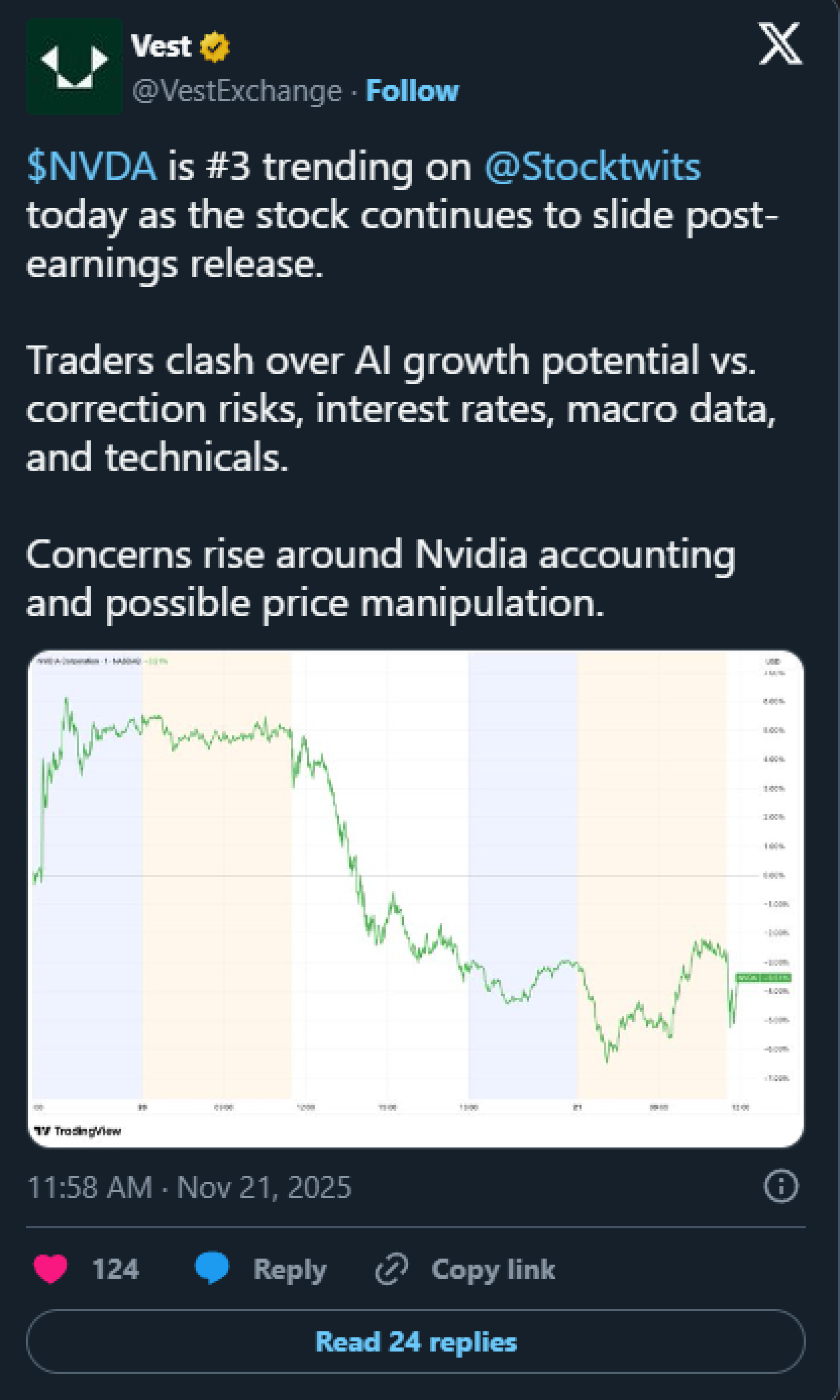

Social Media Strategy, Market Coverage & Monitoring

Our social media strategy was built around high activity, consistency, and education. The goal was not just visibility, but helping users clearly understand how the platform works, building confidence and trust over time.

Through educational content, product breakdowns, and feature-focused posts, we simplified complex DeFi and futures concepts for a broader audience, making Vest Markets approachable to both crypto-native and TradFi traders.

Alongside this, market coverage and real-time monitoring became a core pillar of our strategy. As a team that is both crypto- and trading-native, we actively tracked market shifts, momentum plays, and macro-driven opportunities, translating them into timely, actionable content.

This approach served two key purposes:

Discovery:

Reaching traders who were not yet familiar with Vest, but actively follow markets, equities, and futures discussions, especially across FinTwitter.

Engagement & volume:

Providing existing Vest users with relevant market opportunities that encouraged platform activity and repeat usage.

By consistently speaking the language of traders and demonstrating real market awareness, we reinforced credibility, built trust, and helped drive sustained volume to the platform. Importantly, this strategy acknowledged that TradFi traders are highly active on the so-called FinTwitter.

Perfomance

Performance

Talking numbers, the impact of the transition from pre- to post-rebranding is clear.